CasinòNon AAMS / Senza ADM

302 del 30 12 2015 – Suppl. In riferimento alla segnalazione del disservizio elettrico a Villa Basilica, E Distribuzione società del Gruppo Enel che gestisce. Il che vuol dire che maggiore è l’importo, maggiore è l’aliquota applicata. Questa sigla identifica l’autorizzazione della Malta Gaming Authority MGA, concessa alle piattaforme di gioco che dimostrano di garantire un’esperienza di gioco equa, etica e trasparente. Inoltre, Wild Tokyo offre un programma VIP con cashback fino al 20% e vari bonus settimanali?. In più la piattaforma mette a disposizione dei propri clienti anche una vasta scelta di slot machines.

I Vantaggi dei Siti non AAMS

Sono disponibili poi, oltre a depositi e prelievi con valuta Fiat, anche 13 diverse criptomonete. Gambling e Tasse: uno sguardo generale. LA VOCE DEL CANAVESE Reg. Selezionatelo come metodo di pagamento e inserite le credenziali relative al vostro account per continuare. Una rivista che osserva e narra il fermento delle “nove arti” e che indaga la società odierna al fine di fornire approfondimenti meditati e di lungo respiro. La normativa in Italia è complicata, ma in generale possiamo dire che secondo il regolamento il gioco d’azzardo al di fuori dei 4 casino terrestri e dei casino online legali AAMS è vietato sin dal 1931. La trovata di Planetwin365 permette anche ai giocatori low roller di ricevere un aiuto calibrato sul loro stesso volume di gioco. Per ottenere la licenza, la collaborazione con ADM è un prerequisito. 1, recante: «Disposizioni urgenti per la dignità dei lavoratori e delle imprese. 161 del 14 07 2009 – Suppl. I casino non AAMS richiedono la verifica dei documenti. Ci sono tirature molto importanti, come i 142. Si tratta di una domanda importante, per chi è intenzionato ad allargare i propri orizzonti di gioco online.

Le caratteristiche dei giochi d’azzardo più ricercati

La legalizzazione del gioco d’azzardo significa essenzialmente che agli operatori di casinò è permesso offrire anche scommesse sulle corse articolo dei cavalli e scommesse sportive. Riteniamo fondamentale spiegare al meglio cosa siano i casinò online privi della licenza italiana per il gioco d’azzardo. A proposito del gioco online, è molto importante considerare le normative che regolamentano il mondo del gioco, così da avere un’idea ben chiara sulla situazione attuale, in cui bisogna tener conto del Decreto Dignità in vigore. Questi sono chiaro segno di quanto l’operatore sotto esame sia affidabile e serio. 97 del 28 aprile 2009 Rettifica G. ] Legge 28 dicembre 2015, n. Dal punto di vista del giocatore, partecipare a attività di gioco su piattaforme non AAMS/ADM non è considerato un reato, ma comporta rischi significativi. Esempi di casinò internazionali autorizzati a operare all’estero ma non in Italia, in quanto privi di licenza ADM, sono Casumo, Casino Superlines e La Fiesta Casino. Nel frattempo, la comodità di giocare da casa accresce in maniera significativa il numero di utenti di questi portali, che offrono su un’unica piattaforma una grandissima varietà di giochi classici e di loro varianti. Comunque una delle strategie più comuni è quella di comprare un blocco di biglietti.

Ma come vengono divisi gli incassi?

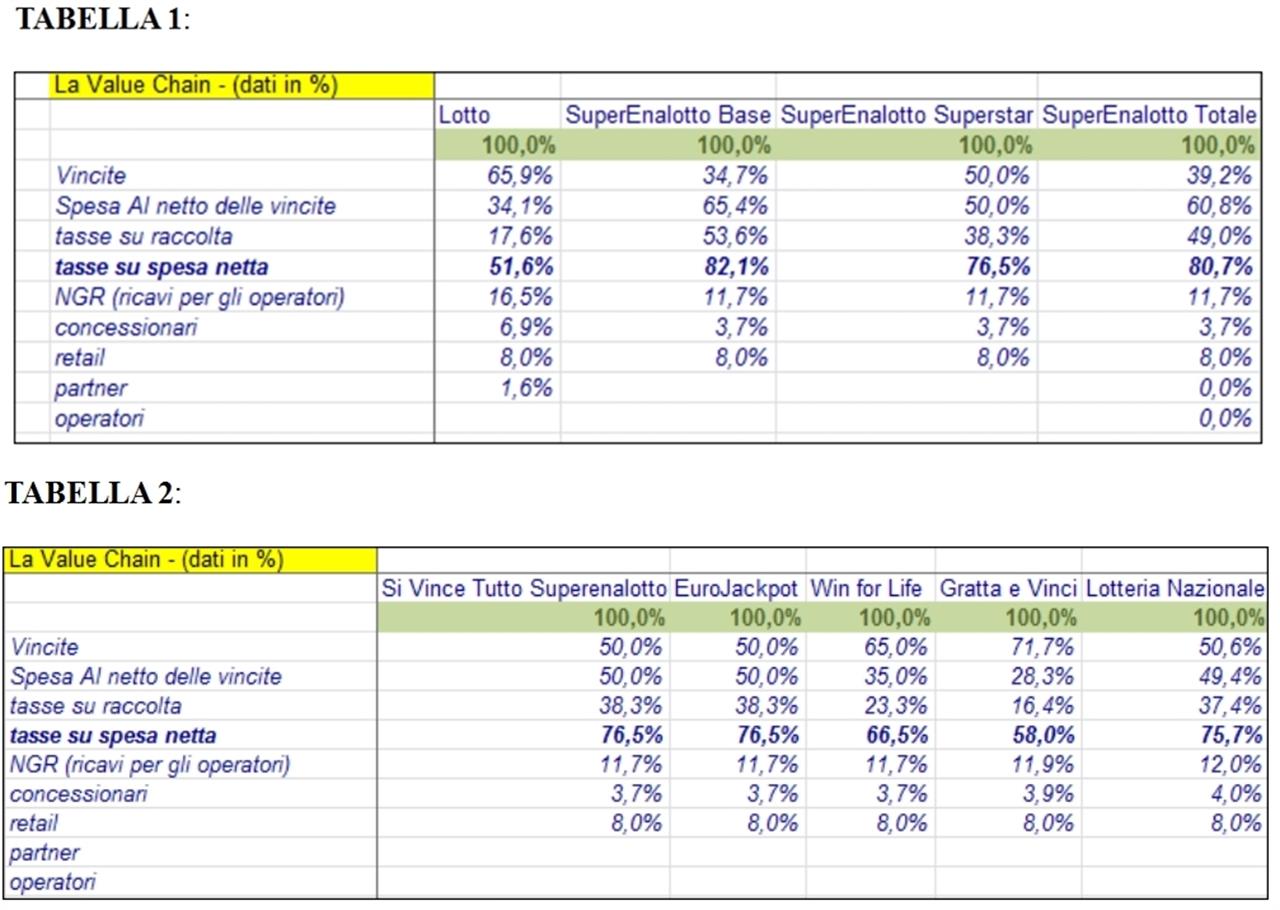

Negli anni il suo prestigio è andato via via aumentando, tanto che da essere riconosciuta come una dei luoghi più esclusivi e prestigiosi d’Europa. Detto in termini profani: la spesa netta è su quanto effettivamente si pagano le tasse, ciò che in termini altrettanto profani potremmo definire “l’utile lordo” del settore. Se volete conoscere ogni tipologia di Gratta e Vinci online potete consultare la sezione che abbiamo preparato per voi su tutti i Gratta e Vinci, vi consigliamo vivamente di leggere la recensione di ogni grattino per avere sempre un’idea chiara delle caratteristiche e capire velocemente se può fare al caso vostro. Com sarebbero autorizzati a esporre uno speciale sigillo, indicante la loro conformità agli standard unificati stabiliti dall’organismo di regolamentazione internazionale. L’interesse delle mafie verso il controllo e la gestione del mondo dei giochi d’azzardo non è mai stata una notizia. Come ti ho già anticipato, i siti non AAMS tendono di solito a chiedere solo alcuni dati essenziali. Il governo italiano ha messo in atto regolamenti che rendono più facile per i giocatori usufruire di bonus e promozioni offerti dai casinò online. Quindi per un italiano giocare su un casinò non AAMS offre di fatto le stesse tutele di un casinò con licenza italiana. Tuttavia, la regolamentazione ha anche suscitato dibattiti sul bilanciamento tra la protezione dei consumatori e la libertà di scelta individuale. Per una caccia efficace, hai bisogno di un personaggio efficace con danni singoli o massicci o della presenza di un gruppo di combattimento che risolva questi problemi. Per restare sul sicuro, scegli solo siti consigliati da NuoviCasinoItalia.

Newgioco casino e bookmaker

Inoltre ha previsto, a decorrere dal 2017, la riduzione del 30 per cento delle newslot rispetto agli apparecchi attivi al 31 luglio 2015. Nel 2003 l’Italia si rese conto che impedire ad altri operatori italiani di agire nel mercato delle scommesse non era affatto una scelta corretta. Dato che sono soggetti sottoposti al controllo dell’Agenzia delle Dogane e Monopoli, quando ottieni una vincita questa sarà già al netto delle guida imposte, in quanto la società che svolge l’attività di casinò online ha la funzione di sostituto d’imposta. Net è anche su WhatsApp e Telegram. Come parte del suo impegno per il gioco d’azzardo responsabile, il governo ha messo in atto leggi e regolamenti che disciplinano il funzionamento dei casinò. Ti ricordiamo però che se ti riconosci nei sintomi della ludopatia la cosa migliore da fare è cercare innanzitutto un aiuto esterno, in modo da poter prevenire problematiche più gravi; il gioco d’azzardo deve rimanere un passatempo dove le vincite sono una gradita aggiunta, e non un’ossessione per guadagnare denaro in modo veloce.

È legale accedere ai casino online stranieri?

CASINO ONLINE STRANIERI. Il ministro delle Finanze israeliano di estrema destra Bezalel Smotrich ha accusato l’ex membro del gabinetto di guerra Benny Gantz di essere favorevole alla fine della guerra a Gaza che ha ucciso più di 15. Mi ha risposto che non può dare consigli illegali o immorali. I casinò online non AAMS offrono un’ampia gamma di metodi di pagamento, tra cui carte di credito e di debito, portafogli elettronici, bonifici bancari e persino criptovalute. Tags: casino, casinononaams, gambling. Questo garantisce che i migliori casinò non AAMS operino in modo equo e trasparente. Risposta: In caso di cambio del rappresentate legale, il nuovo rappresentate deve chiedere le credenziali a suo nome come persona fisica o eventualmente come ditta individuale qualora il rappresentante legale sia dotato di partita iva. La grande notizia è che qualsiasi vincita ottenuta durante questi giri gratuiti sarà tutta per te: quindi, se la fortuna è dalla tua parte, potresti finire per portare a casa un fantastico premio senza nemmeno dover scommettere i tuoi soldi. Scopriamo insieme quali sono. I casino non AAMS, infatti, prevedono una fase di registrazione molto snella. Questo può rendere difficile la navigazione del sito e la comprensione dei termini e delle condizioni di bonus e promozioni. Riconoscere un sito di casinò online affidabile e legale richiede attenzione e informazione.

QUARTA FASE

Tutto è iniziato a cambiare nel 2012, con l’introduzione del Decreto Balduzzi, ossia del decreto legge n. Scopri di più sulla nuova normativa europea che regola il trattamento dei dati personali dei giocatori al casinò online. Ciò li mette alla pari con le loro controparti con licenza ADM, almeno in termini di sicurezza. 8 del 2013, nel testo novellato dalla r. Si tratta di un sito non AAMS completo che offre ai propri clienti diversi giochi da tavolo, comprendendo i famosi Roulette, Blackjack, Poker, Baccarat e molti altri e una sezione dedicata alle scommesse sportive, con eventi giornalieri e sport virtuali. Un altro punto di controversia è la licenza AAMS stessa. La Roulette è forse il gioco più sociale del mondo dei casinò, e ci sono sempre tante persone che giocano online nelle live room dei casinò online non AAMS. È noto per la sua ampia offerta di scommesse sportive e giochi da casinò.

Servizi

Oggi i giochi d’azzardo più diffusi sono le video lottery e le slot machine spesso chiamate ancora videopoker, i gratta e vinci, il lotto e il Superenalotto, i giochi al casinò, il “Win for life”, le scommesse sportive o ippiche, il bingo, i giochi online con vincite in denaro ad esempio, poker online. Il volume si pone dunque quale strumento utile al professionista, civilista, penalista e amministrativista, che debba affrontare questioni legate alla dipendenza da gioco, con le ricadute pratiche che ciò comporta, anche in relazione a terzi soggetti coinvolti dal fenomeno, quali familiari e conviventi. I siti non AAMS spesso offrono una selezione più ampia di giochi e opzioni di scommesse, così come migliori bonus e promozioni. Inoltre, i gateway di pagamento sicuri, la tecnologia di crittografia e le verifiche regolari da parte degli organi di regolamentazione aiutano a garantire trasparenza e integrità. Secondo uno studio pubblicato recentemente da Giochidislots, la categoria «Apparecchi da intrattenimento» è quella che contribuisce maggiormente alle entrate erariali, con il 54,77% del totale. A favorirla è il fatto che molti giocatori non amano la freddezza tipica dei software di gioco e preferiscono quindi optare per le sezioni dal vivo. Questo tipo di organizzazione dei contenuti rivela a mio giudizio anche la natura di bookmaker non improvvisati dei gestori del sito, come invece penso quando trovo siti non AAMS con un po’ di eventi piazzati alla rinfusa. 000 euro con un ulteriore costo di 46. La raccomandazione finale. Prima però, è necessario approfondire la normativa italiana, al fine di ottenere una conoscenza completa a riguardo. Questo processo può essere tedioso e consumare una parte significativa del tempo che vorresti dedicare semplicemente a divertirti. Quesito Quali sono le modalità; per giocare on line al SuperEnalotto e al SuperStar. I metodi di pagamento includono anche carte di credito, e wallet e criptovalute, permettendo ai giocatori italiani di effettuare depositi e prelievi con incredibile facilità. Il nostro consiglio è di scegliere sempre casinò online ADM per giocare in completa sicurezza e senza inutili grattacapi.

Si può giocare legalmente in un casinò senza Aams o Adm?

302 del 29 12 2017 – Suppl. Iscrizione ROC:35268 Codice Univoco: P62QHVQ. Uno dei siti più consigliati, che fornisce anche un utile numero verde, è. La tassazione sui giochi è quindi una voce di entrata enorme per lo Stato italiano; il quale cerca di cavalcarla come meglio può, ricavandone il più possibile. Tramite l’app ufficiale My Lotteries è possibile giocare al Gratta e Vinci online. Risposta: Il giocatore, che deve essere maggiorenne e in possesso del codice fiscale, stipula un contratto per l’apertura di un conto di gioco con un punto vendita a distanza, che può; essere la società SISAL, concessionaria dei giochi numerici a totalizzatore nazionale GNTN, o un concessionario di altri giochi autorizzato alla raccolta a distanza dei GNTN. Normativa Europea: ecco cosa prevede.

Stati Uniti d’America

Iscriviti alla Newsletter per ricevere gli aggiornamenti dai portali di BitMAT Edizioni. Questa diversità assicura che ogni tipo di giocatore possa trovare il gioco che più si adatta ai propri gusti e alle proprie competenze. Noi di CasinoItaliani ti consigliamo vivamente di verificare sempre la legalità del casinò online con cui stai giocando, prima di effettuare pagamenti e iniziare a giocare. Di seguito riportiamo l’elenco dei Gratta e Vinci dal costo di 2 euro. Tra i casino non AAMS rappresenta una delle aziende più note in assoluto, nonostante un debutto avvenuto soltanto nel corso del 2020. Inoltre, dovrai trovare i numeri di telefono a cui fare riferimento nel caso in cui ritenessi di essere un giocatore ludopatico, così da ricevere subito l’aiuto necessario. La sicurezza è garantita da protocolli di crittografia avanzati per proteggere i dati degli utenti. Tuttavia, il loro accesso non implica che sia legale utilizzarli dall’Italia. Diciamo però che la legge italiana continua a tenere d’occhio non solo le regole relative ai casinò online, con un occhio puntato alle norme sulla ludopatia e gioco minorile, ma continua a regolamentare anche il settore fisico del gioco d’azzardo. BONUS DI BENVENUTO FINO A. Al contrario, coinvolge un numero sempre crescente di casinò online, capaci di intrattenere più giocatori che in passato. Eurobet è un casino online aams sicuro e legale, come tutti i casino online aams autorizzati. Com offrano una maggiore varietà di giochi e bonus allettanti, l’assenza di un controllo normativo comporta rischi intrinseci. Skrill è, insieme a Paypal, un altro dei sistemi di pagamento più utilizzato dai giocatori per effettuare transazioni finanziarie nei casinò online non Aams.

Il ruolo del Gil

Ci chiediamo se i metodi di pagamento in questi casinò online siano differenti dai soliti. 232/2016 ed entrato in vigore il 1° febbraio 2021 per incentivare l’utilizzo delle carte di credito, di debito e prepagate. In particolare non vi deve essere un riferimento anche indiretto ai minori ed è vietato l’utilizzo di segni, disegni, personaggi e persone, direttamente e primariamente legati ai minori. La grande notizia è che qualsiasi vincita ottenuta durante questi giri gratuiti sarà tutta per te: quindi, se la fortuna è dalla tua parte, potresti finire per portare a casa un fantastico premio senza nemmeno dover scommettere i tuoi soldi. Questo casinò sul web mette a disposizione molti giochi, come: slot machine, poker online e Bingo, comprese le scommesse sportive. 21 del 2014 dell’Umbria; art. I regolamenti dei casinò online in Italia sono tra i più severi in Europa. Il bonus di benvenuto è la principale promozione per ogni piattaforma di giochi e scommesse online, altra grande caratteristica dei migliori casino senza licenza, sia che si tratti di casino non AAMS che di quelli provvisti di licenza rilasciata in Italia. Solo dopo aver soddisfatto questi requisiti si può entrare a far parte della lista casino online AAMS, che verranno poi sottoposti ai controlli previsti dalla legge con frequenza periodica, atta a garantire la liceità dell’operatore nel tempo, come esamineremo nel prossimo paragrafo. Abbiamo poi testato centinaia di casinò non AAMS per sondare il loro meccanismo di funzionamento e elenco delle migliori piattaforme di gioco. AmunRa è un casino espressamente dedicato all’antico Egitto.

I risultati delle Comunali in Calabria: ballottaggio Cosentino Romeo a Vibo e a Corigliano Rossano vince Stasi

Giocare online al Gioco del Lotto, al 10eLotto e al MillionDAY tramite smartphone e tablet è possibile installando l’app My Lotteries sul proprio dispositivo mobile. Il sito offre una lista di casino online che sono stati attentamente valutati e che possiedono una licenza valida in Italia. È vero che ci sono stati problemi con alcune aziende nel passato, comunque oggi gli utenti possono affidarsi senza problema. Ogni casinò può avere limiti minimi e massimi di prelievo diversi, quindi assicuratevi di controllare le loro condizioni specifiche. Il gioco d’azzardo digitale è soggetto alla tassazione in Italia. Non possiamo dire che sia un’esperienza uguale, anche perché il fascino del grattino cartaceo rimane sempre e comunque iconico, in ogni caso le piattaforme stanno lavorando molto bene per rendere l’esperienza online sempre più simile all’esperienza reale di gioco. Nel mondo dell’intrattenimento digitale, i casinò online rappresentano una delle industrie più fiorenti e dinamiche degli ultimi anni. Espansione Globale: I casinò non AAMS facilitano l’espansione globale dell’industria del gioco d’azzardo online, raggiungendo giocatori in mercati in cui il gioco d’azzardo online è legale o meno regolamentato.

App and Device

In questo elenco si trovano le più note aziende del settore come Snai, Eurobet, Betway, 888 Casino, Starvegas, Gioco Digitale, Pokerstars Casino, Bwin, Lottomatica e molti altri. Ma come si riconosce un operatore in possesso di licenza ADM. Come ben sapete, negli USA sulle tasse non si scherza mai: l’FBI e IRS non perdonano. Questo è pensato per coloro che hanno bisogno di aumentare le loro possibilità di vincita, casinò non aams discover Derby Dollars e Treasure Chambers. Solitamente offrono una varietà di metodi di pagamento, tra cui carte di credito, portafogli elettronici e bonifici bancari, con ogni transazione protetta da robuste misure di sicurezza. Continua a leggere per capire quali sono i gratta e vinci più vincenti.

Riordino del gioco pubblico in pericolo, ma si discute solo su questioni territoriali

Queste misure di protezione per giocatori d’azzardo includono limiti sui depositi, verifiche dell’età e programmi per la promozione del gioco responsabile. E’ possibile scommettere in questo casinò online, con numerosissimi sport tradizionali, ma anche ai nuovissimi e in continua crescita eSports. I dati presentati aiuteranno a fornire nuove e mirate risorse I. A tale scopo l’Agenzia delle Entrate ha sviluppato un’applicazione soprannominata SMART Statistiche, Monitoraggio e Analisi della Raccolta Territoriale del gioco fisico la quale monitora la distribuzione dei punti vendita dei giochi pubblici sul territorio e l’offerta degli stessi a livello nazionale, regionale, provinciale e comunale. A sei anni e con la multa da euro 20. Esempio pratico: Se la pallina si ferma sul numero 4 per 3 giri consecutivi e 10 giocatori hanno scommesso almeno 5€ per ogni spin durante le ripetizioni, ciascuno vincerà 25€ del Jackpot calcolato come 250€ diviso 10. ] Per “Vincite” s’intende il valore totale delle somme vinte dai giocatori. Anche i presentatori apprezzano molto interagire con gli utenti, come sostenuto da Gemma Bailey, presentatrice dal 2019:”Come presentatrice di giochi da tavolo in un casinò, ho l’onore di incontrare nuove persone ed intrattenerle ogni giorno. Synergy Casino España. Vi autorizzo alla comunicazione dei miei dati personali per comunicazione e marketing mediante posta, telefono, posta elettronica, sms, mms e sondaggi d’opinione ai partner terzi. ] Decreto legge 12 luglio 2018, n. Approfondiamo quindi il concetto di “Triangolo di Lavoro”. Honeywell Printhead spare for Intermec label printer PX6i, resolution 8 dots/mm 203dpi.

L’abbonamento adatto alla tua professione

Durante il periodo di autoesclusione il giocatore. Per qualsiasi informazione aggiuntiva sulle promozioni puoi contattare l’assistenza clienti, interamente fornita in italiano. La sicurezza dei giocatori passa dunque attraverso la selezione dei soli portali che offrono loro specifiche condizioni di gioco, favorevoli e protette. 10, comma 4, della suddetta l. É vietata la riproduzione, anche parziale e con qualsiasi mezzo, di tutti i materiali del sito. In questo articolo abbiamo esaminato i vari metodi e approcci che gli operatori di casinò hanno utilizzato con successo per attirare l’attenzione dei giocatori italiani.

200% fino a 500€100 Free SpinPlaythrough 35x

Il bonus di benvenuto è un elemento essenziale in ogni casinò di qualità. Artcolo 1, comma 1052. In primis, può essere utile impostare dei limiti e non superarli, anche laddove la fortuna dovesse essere dalla nostra parte. In Italia tutta la regolamentazione, la vigilanza sugli operatori e il rilascio delle licenze per il gioco pubblico vengono gestiti da ADM, l’ente istituito dal Ministero dell’Economia e delle Finanze che obbliga i siti a rispettare tutte le norme in materia di sicurezza di dati e transazioni e regolarità dei giochi. It non sono destinati a persone di età inferiore ai 18 anni. Il motivo è facilmente comprensibile: molti di loro preferiscono il contatto umano alla freddezza dei software di gioco e lo trovano nel casino dal vivo. La terza fase si ha dal 2003 al 2010 ed è proprio nel 2003 che lo Stato italiano vuole rendere il gioco d’azzardo un settore economico indipendente, ma per raggiungere questo obiettivo è stata necessaria una riorganizzazione del settore: il punto di partenza si ha con la Legge 18 ottobre 2001, n. Più soldi per giocare significano molte più chance di vincere senza avere alcun rischio in più. La terza fase si ha dal 2003 al 2010 ed è proprio nel 2003 che lo Stato italiano vuole rendere il gioco d’azzardo un settore economico indipendente, ma per raggiungere questo obiettivo è stata necessaria una riorganizzazione del settore: il punto di partenza si ha con la Legge 18 ottobre 2001, n. ] Legge 28 dicembre 2015, n. Con una vasta scelta di criptovalute per depositi e pagamenti, gli appassionati del genere si sentiranno davvero a casa. Non è infatti sufficiente esibire un pezzo di carta dato da qualche organismo sconosciuto.

Aspetti contabili e fiscali agenzie immobiliari

In effetti questa seconda impostazione è conseguente all’esistenza della ludopatia. 22BET Bookmaker non aams alla pari di Powbet – 100% Fino a €122 – REGISTRATI ORA. La quarta fase inizia nel 2011 ed è ancora in corso. I bonus di benvenuto, poi, hanno percentuali di rimborso più elevate e la possibilità di essere riscattati più rapidamente rispetto a quelli dei siti di casino italiani. Nel corso degli anni, ho avuto l’opportunità di esplorare molte di queste piattaforme. È possibile, infatti, scoprire se il proprio biglietto è vincente seguendo le procedure determinate dal regolamento ufficiale e che variano a seconda del formato del tagliando e della tipologia di Gratta e Vinci di cui si è in possesso. 600 del 1973 ed inserendo all’interno dell’art. Senza la supervisione dell’AAMS, i casinò online non AAMS potrebbero non garantire l’equità dei loro giochi.

Advertisement

Costi di commissione – zero. Nel complesso però, ritengo che queste problematiche siano più che bilanciate dai vantaggi dei casino online italiani. Questo non solo aumenta le possibilità di successo, ma previene anche frustrazioni e malintesi. La maggior parte dei paesi europei consente e regolamenta le scommesse sportive, inclusi Regno Unito, Germania e Francia. I casinò non AAMS tendono a offrire bonus di benvenuto più consistenti, promozioni regolari e programmi fedeltà più vantaggiosi rispetto ai casinò AAMS. Per informazioni o per inviare una segnalazione Whatsapp / Telefono +39 351 309 1930 /email: stabianews. Nonostante queste limitazioni, però, rappresentano un parametro importante nell’operazione di selezione e classificazione dei migliori casinò, consentendo di farsi un’idea dei vari pro e contro che si potrebbero sperimentare testando in prima persona il sito.

Definizione agevolata accise, giochi e sanzioni doganali

Uno dei principali indicatori di affidabilità per un casinò online è la sua licenza e la regolamentazione. ] Testo del decreto legge 26 ottobre 2019, n. L’Italia ha anche creato un organismo AAMS per governare le operazioni di gioco d’azzardo nella regione. Ma come regolarsi con il Fisco in caso di vincite. Questa è la grande domanda per la maggior parte degli scommettitori e la risposta è sì. Inoltre, i casinò online che sono ‘casino online sicuri e conformi alle leggi’ dimostrano il loro impegno nel rispettare gli standard normativi italiani, dando ai giocatori la tranquillità quando partecipano alle attività di gioco online. Cerchiamo casinò online che abbiano interfacce intuitive e facili da usare e che permettano ai giocatori di navigare facilmente tra i diversi giochi offerti. 8 del 2013, viene equiparato a nuova installazione e, quindi, deve essere sanzionato ai sensi dell’art.

CONTATTI

Per ogni serie viene stampato un primo lotto. Controlla anche se il casinò è regolamentato da un’autorità di gioco rispettabile e se ha ottenuto certificazioni di sicurezza da enti indipendenti. Le autorità di regolamentazione possono imporre restrizioni sulle offerte dei bonus e richiedere che i casinò online rispettino standard di trasparenza e equità. Uno è solo per i giocatori in Finlandia e l’altro è internazionale, il ritiro potrebbe richiedere fino a 10 giorni lavorativi per l’elaborazione. Come posso proteggere la mia sicurezza mentre gioco su siti non AAMS. Quesito Si può giocare anche all’estero. In realtà, gli svantaggi in questo caso riguardano essenzialmente le sfere del pagamento e il blocco IP.